Leisure Services & Supplemental Education website (note outdated pool event)

If Amherst Police, Fire and DPW departments suddenly vanished, chaos would soon ensue. But should our recreation department disappear, most people would not even notice...and the private sector would quickly and easily fill the void.

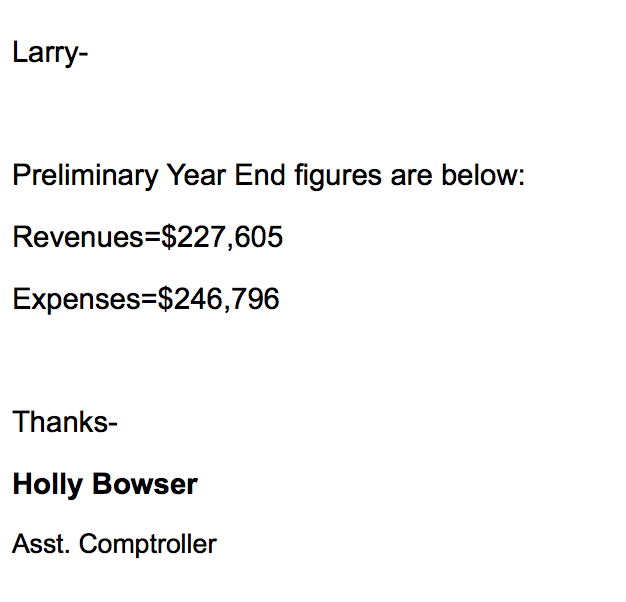

In addition to the $43,000

lost last fiscal year on the luxurious game of golf, the recreation department--also known as

Leisure

Services and

Supplemental

Education--lost an additional $92,792 on other sport/fitness programming.

Overall LSSE expenses topped $1.1 million with revenues at $977,514...far short of break even . This $122, 486 in

red ink combined with the $197,000 hidden cost of

employee benefits, paid from a separate part of the town operating budget, brings losses last year to a whopping $319,486. For RECREATION.

And this is far from an anomaly as LSSE budget deficits demonstrate a downward trend over the past few years. Unlike the decline of the Roman Empire, the excuse will be weather and the economy.

Last spring Town Meeting approved a new $400,000 revolving fund for LSSE "after school programs". The schools kicked out private programs that had been in place for a generation and cost the taxpayers

nothing, to be replaced by this same failing business model.

Interestingly the government sponsored program at Crocker Farm--"Prime Time"-- that had been competing head-to-head with the private "Crocker Care", missed budget projections by a significant amount (budgeted at $27,000 but only generating $15,000).

If LSSE can't handle recreation--its core business for 30 years now--how well is this expensive new after school business going to fare?

Another hidden cost of government sponsored programs is that they are tax exempt. Simply put, private business generates tax income while government programs consume them.

For instance,

Hampshire

Athletic

Club, which has to unfairly compete with LSSE rec programs, paid the town $36,000 last year in property taxes. And their employees are for the most part full-time professionals trying to make a living at sports/recreation rather than the part-time, independent contractors LSSE relies on.

Even tax exempt Amherst College paid the town $8,000 in property taxes for their Amherst Golf Course which competes with the Cherry Hill Golf Course, a ravenous White Elephant that required taxpayer bail outs of over $1 million to cover operational losses over the past ten years.

Government is

vital for providing essential services--especially relating to public safety. Recreation is a different matter altogether.

Why should hard pressed senior citizens living on a fixed income subsidize the recreational activities of the few who can--for the most part--afford to pay the actual cost of their "

leisure services"?